-

Call Us

0086-592-7161550 -

Email us

ping@aotbattery.com -

Skype

ping@aotbattery.com

Call Us

0086-592-7161550Email us

ping@aotbattery.comSkype

ping@aotbattery.comChina has abundant lithium resources and a complete lithium battery industry chain, making it the world's largest lithium battery material and battery production base. In recent years, due to the demand for new energy vehicles, consumer electronics, and energy storage industries, lithium-ion battery materials have grown rapidly. Lithium ion batteries are mainly composed of four key materials: positive electrode material, negative electrode material, separator, and electrolyte, with cost proportions of 45%, 15%, 18%, and 10%, respectively.

1. Positive electrode material

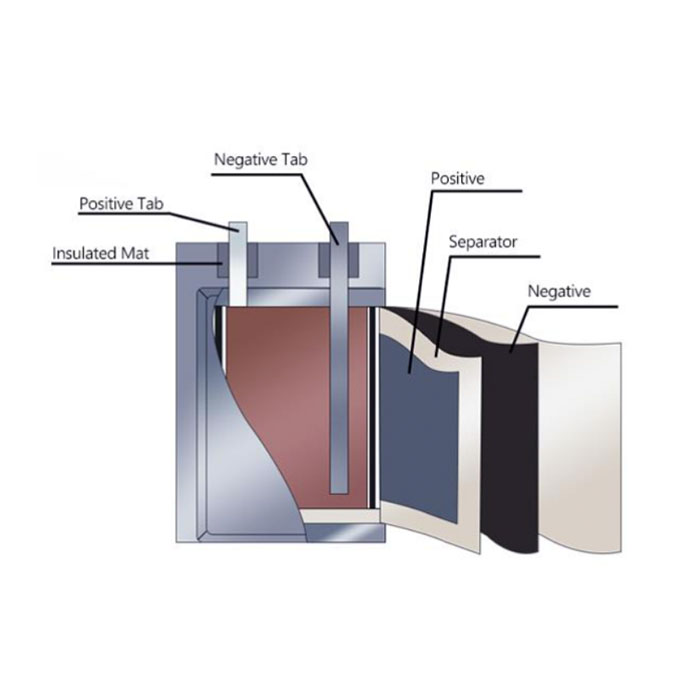

The positive electrode material accounts for the highest proportion of the total cost of lithium-ion batteries, and its performance directly affects the core performance indicators of lithium-ion batteries, such as energy density, safety, and cycle life. The positive electrode material serves as a lithium-ion source and has a high electrode potential, resulting in a high open circuit voltage for the battery. Structure diagram of lithium-ion batteries: Data source: Public information. According to the classification of positive electrode materials, lithium-ion batteries can be divided into technical routes such as lithium cobalt oxide, lithium manganese oxide, lithium iron phosphate(LiFePO4), and ternary materials. The current positive electrode materials mainly maintain a parallel pattern of lithium iron phosphate and ternary materials. The energy density improvement space of ternary material batteries is much greater than that of lithium iron phosphate cathode materials, while lithium iron phosphate batteries have the advantages of lower cost and relative safety. According to Baichuan Yingfu, China is expected to add a total of 1.625 million tons of lithium iron phosphate production capacity in 2023. From the perspective of market structure, the concentration of China's lithium iron phosphate industry is relatively high, with Hunan Yuneng and Defang Nanotechnology accounting for a relatively high proportion of production capacity, closely by manufacturers such as Changzhou Lithium Source, Hubei Wanrun, Rongtong High tech, Hunan Shenghua, Chongqing Terui, and Guoxuan High tech Power Energy. Ternary materials refer to positive electrode materials composed of nickel cobalt manganese or nickel cobalt aluminum, namely nickel cobalt manganese oxide (NCM) or nickel cobalt aluminum oxide (NCA). NCM ternary materials are the main ternary materials used by Chinese enterprises. Their advantages lie in energy density, and the higher the nickel content, the higher the specific capacity. They are widely used in new energy passenger vehicles. Due to its high cost, it is mainly used in mid to high end vehicle models. The future high nickel production has a large market space and is also a key direction for technology research and industrialization of various ternary cathode material manufacturers. As of 2022, multiple positive electrode manufacturers have achieved the shipment of 9 series and above ultra-high nickel products. The top three production capacity of ternary materials in China are Rongbai Technology, Betray, and Huayou Cobalt Industry. As of the end of October 2022, the production capacity of the three companies mentioned above was 150000 tons, 83000 tons, and 80000 tons, accounting for 18.9%, 10.5%, and 10.1% respectively, with a CR3 of 39.5%. Tianjin Bamo and Dangsheng Technology both have a ternary material production capacity of 55000 tons, accounting for 6.9% of the total, and a CR5 of 53.4%.

2. Negative electrode materials

The negative electrode materials are currently dominated by graphite materials and are being upgraded to silicon-based negative electrode materials. In the first half of 2022, the shipment of artificial graphite negative electrode materials accounted for 85%, while natural graphite negative electrodes accounted for 15%, which is basically the same as the previous year. Driven by the demand in the power and energy storage market, artificial graphite has better consistency and recyclability compared to natural graphite, leading to an increase in the proportion of artificial graphite. The negative electrode material market has a good pattern and further concentration, with Betray accounting for 26%, Shanshan Shares accounting for 13%, CR3 accounting for 50%, and CR6 accounting for 76%.

3. Separator

The performance of the separator determines the interface structure and internal resistance of lithium batteries, directly affecting the battery capacity. The main function of the separator is to separate the positive and negative electrodes of the battery, prevent short circuits caused by contact between the two poles, and also have the function of allowing electrolyte ions to pass through. The proportion of wet separator production process in China is 75.12%, which is the mainstream production process. From the perspective of market structure, the concentration of China's separator industry is relatively high, presenting a situation of "one super and two strong". The top three are Enjie Group, Xingyuan Materials, and Zhongcai Technology, closely by ZTE Innovation, Hebei Jinli, Henan Huiqiang, and other manufacturers.

4. Electrolytes

According to EVTank statistics, in 2022, the global shipment of lithium-ion battery electrolytes exceeded one million tons, reaching 1.043 million tons, a year-on-year increase of 70.4%. The shipment volume of Chinese electrolytes increased by 75.7% year-on-year, reaching 891000 tons, accounting for 85.4% of the global electrolyte market. The components of the electrolyte include organic solvents, lithium salts, and solutes. Among them, the cost of lithium salts accounts for the largest proportion of the total cost of electrolytes, at 45%, which has a significant impact on the price of electrolytes. The cost of solvents and additives accounts for 25% and 20%, respectively. From the perspective of the electrolyte market pattern, there have been significant changes in 2022 compared to 2021. The leading position of Tianci Materials in the industry has further stabilized, with its market share increasing from 28.8% in 2021 to 35.9% in 2022; Guotai Huarong's third position in the industry has been replaced by BYD; The competition between Kunlun Chemical, Sinochem Blue Sky, Fanlaite, and Zhuhai Saiwei is in a state of anxiety; The CR10 of China's electrolyte industry has increased from 84.3% in 2021 to 88.3% in 2022.Tianci Materials ranks first with a shipment volume of 320000 tons, and companies with over 100000 tons also include New Zebang and BYD. According to the "White Paper on the Development of China's Lithium ion Battery Electrolyte Industry (2023)", Yienke Tianrun, with a foreign investment background, squeezed into the top ten domestic electrolyte shipments in 2022, replacing Luoyang Dasheng, a top ten enterprise in the industry in 2021. According to EVTank's statistical data in the white paper, according to the current expansion plans of major enterprises, the planned production capacity of Chinese electrolyte enterprises will exceed 8 million tons by 2025. With a large number of upstream enterprises in the industry chain, including Shida Shenghua and Yongtai Technology, entering the electrolyte field on a large scale in 2022, competition in the electrolyte industry will become more intense.

Tel/Whatsapp: 0086-592-7161550

Scan to wechat: